When it comes to taking out a loan, whether for a home, car, or personal expenses, making an informed decision can save you thousands of dollars over time. One of the most powerful tools at your disposal is a loan calculator tool. These online calculators help you compare different loan options, interest rates, and repayment terms so you can choose the best deal for your financial situation.

In this article, we’ll walk you through how to use a loan comparison calculator, explain why comparing loan options is essential, and highlight some of the best free loan calculator tools available today. Whether you're a first-time borrower or looking to refinance, this guide will help you make smarter lending decisions.

Why You Should Use a Loan Calculator Tool

Before diving into the details of using a loan comparison calculator, it's important to understand why these tools are so valuable.

1. Saves Time and Money

Manually calculating monthly payments and total interest can be time-consuming and error-prone. A loan calculator tool automates the process and gives you accurate results in seconds. This helps you avoid costly mistakes and ensures you're aware of what each loan will cost you in the long run.

2. Helps You Compare Loans Effectively

With so many lenders offering similar products, it can be hard to know which one is truly the best fit. A loan comparison calculator allows you to input the key details (like loan amount, interest rate, and term) for multiple loans and see side-by-side comparisons of their costs.

3. Improves Financial Literacy

Using a loan calculator tool can also improve your understanding of how interest works, how repayment schedules function, and what factors influence your monthly payment. This knowledge empowers you to negotiate better deals with lenders and avoid predatory financing practices.

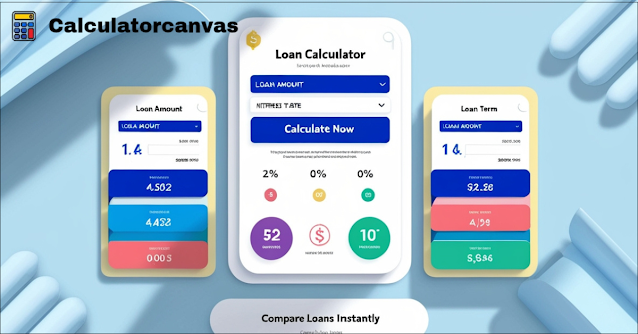

Loan Calculator Tool

How to Use a Loan Comparison Calculator

A loan comparison calculator is typically easy to use. Here’s a step-by-step guide:

Step 1: Choose the Type of Loan

Start by selecting the type of loan you’re interested in—whether it’s a personal loan, auto loan, mortgage, or student loan. Each type has its own set of variables that affect the calculation.

Step 2: Input the Loan Details

You'll need to enter the following information:

- Loan amount: The total amount you plan to borrow.

- Interest rate: The annual percentage rate (APR) offered by the lender.

- Loan term: The length of the loan in months or years.

Some advanced calculators may also ask for additional details like fees, down payments, or tax implications.

Step 3: View the Results

After entering the data, the loan calculator tool will display your estimated monthly payment, total interest paid over the life of the loan, and the total repayment amount. Some tools also show an amortization schedule, which breaks down each payment into principal and interest components.

Step 4: Compare Multiple Loans

If you’re considering more than one loan offer, repeat the process for each one. Then, compare the results side by side to determine which option is the most affordable and fits your budget best.

Read also : Unlock Your Dream Car: Use Our Car Loan Interest Rate Calculator to Estimate Your Monthly Payments

Key Features of the Best Loan Calculator Tools

Not all loan calculator tools are created equal. When choosing one, look for the following features:

1. User-Friendly Interface

The best calculators are intuitive and easy to navigate. They should allow you to input your data quickly and generate clear, understandable results without requiring a finance degree to interpret them.

2. Customizable Options

Look for a loan comparison calculator that lets you adjust variables like loan amount, interest rate, and term. The ability to experiment with different scenarios helps you find the ideal loan structure for your needs.

3. Side-by-Side Comparisons

One of the most valuable features is the ability to compare two or more loans simultaneously. This feature saves time and makes it easier to spot the best deal at a glance.

4. Detailed Reports and Visualizations

The best loan calculator tools often include charts, graphs, and downloadable reports that help you visualize your repayment timeline and total costs. These visuals can be especially useful when discussing loan options with a financial advisor or family member.

5. No Hidden Fees or Ads

Avoid calculators that try to upsell you or display too many ads. The best loan comparison calculator should be clean, fast, and focused on helping you make an informed decision.

Top 5 Loan Calculator Tools to Try

Here are five highly-rated loan calculator tools that you can use right now to compare loan options and find the best deal:

01 Home Equity Loan Calculator (HEL):

Easily calculate your home equity loan payments and interest savings with our free online tool. Compare rates and terms to find the most affordable option for your financial goals.

View More

Interest-Only Loan Calculator (IOL):

Estimate monthly payments for interest-only loans and evaluate long-term costs. Simplify your borrowing decisions with this user-friendly calculator.

View More

07 Home Equity Loan Calculator (HEL):

Plan your HEL repayments accurately with this advanced calculator. Input custom terms to analyze interest rates, loan durations, and potential savings.

View More

07 Simple Interest Loan Calculator:

Quickly compute simple interest payments for personal or business loans. Understand total repayment amounts and optimize your budgeting strategy.

View More

02 Simple Interest Loan Book & Calculator:

Master loan basics with our expert guide and companion calculator. Learn to calculate interest, compare lenders, and secure the best deals in 2024.

View More

Optimized for keywords: "loan calculator," "interest savings," "affordable loans," "compare rates," "borrowing strategy."

Read also: Fast Estimate: Your EduCalc Financial Tools Student Loan Grace Period Interest Calculator (Estimate Accrual)

What to Look for in Loan Interest Rates

One of the most critical factors when comparing loans is the interest rate. A lower interest rate means you’ll pay less in total interest over the life of the loan, which can save you thousands of dollars.

However, don’t just focus on the nominal interest rate. Be sure to compare the annual percentage rate (APR), which includes both the interest rate and any additional fees associated with the loan. The APR gives you a more accurate picture of the true cost of borrowing.

Also, consider the type of interest rate—fixed vs. variable. A fixed-rate loan has an interest rate that remains the same throughout the entire loan term, while a variable-rate loan can change based on market conditions. Fixed rates offer more predictability, while variable rates may offer lower initial rates but come with more risk.

Understanding Loan Terms and Repayment Schedules

Another important factor to consider when using a loan comparison calculator is the loan term. The term refers to how long you have to repay the loan, and it directly affects your monthly payment and total interest.

Longer-term loans generally have lower monthly payments but result in higher total interest costs. Shorter-term loans have higher monthly payments but cost less overall. Your choice depends on your financial goals and budget constraints.

An amortization schedule is a table that shows how much of each monthly payment goes toward paying off the principal versus the interest. Over time, more of your payment goes toward the principal, and less toward interest. Understanding this concept can help you make better decisions about early repayment or refinancing.

Tips for Using a Loan Calculator Effectively

To get the most out of your loan comparison calculator, follow these tips:

- Compare at least three loan offers to ensure you’re getting the best deal.

- Adjust variables like loan amount and term to see how they affect your monthly payment.

- Use the calculator to explore early repayment options if you want to pay off your loan faster.

- Print or save the results for future reference or to share with a financial advisor.

Final Thoughts: Make Informed Loan Decisions

In today’s competitive lending market, using a loan comparison calculator is one of the smartest things you can do. These tools empower you to compare loan options, interest rates, and terms with ease and accuracy.

By taking the time to explore your choices and calculate the true cost of each loan, you can avoid common pitfalls and find the best possible deal for your financial situation. Whether you're shopping for a mortgage, auto loan, or personal loan, a loan calculator tool is your best ally in making a confident, informed decision.

So next time you're in the market for a loan, don't just go with the first offer you receive. Take control of your financial future by using a loan comparison calculator to compare your options and choose the best path forward.

![The Ultimate Guide to Paint Color Mixing Ratios [2025]: Save Time, Nail Precision & Ditch Guesswork](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEgTdw8HvF1atCM5QCPzNSElGw_68iR94GiSS1cK1jhvibDNYaHvlQM4ej9dLg3cI29C_zPz2e7IaVxAFt82c_VwBr9sEv0Lv8gayJ78YcCQ_mJqbjtJU-TDGupLDLBoR3RR6sak3V0G9FEjxoyqsdsx44LKwyTbbMR6JQ3JCty85n0QJchYAAt82KeDRd8B/w72-h72-p-k-no-nu/Scientific%20Calculator_20250330_074225_0000.png)

0 Comments